Why Employ A Wedding Advisor?

페이지 정보

작성자 Leonardo 댓글 0건 조회 6회 작성일 24-09-28 20:23본문

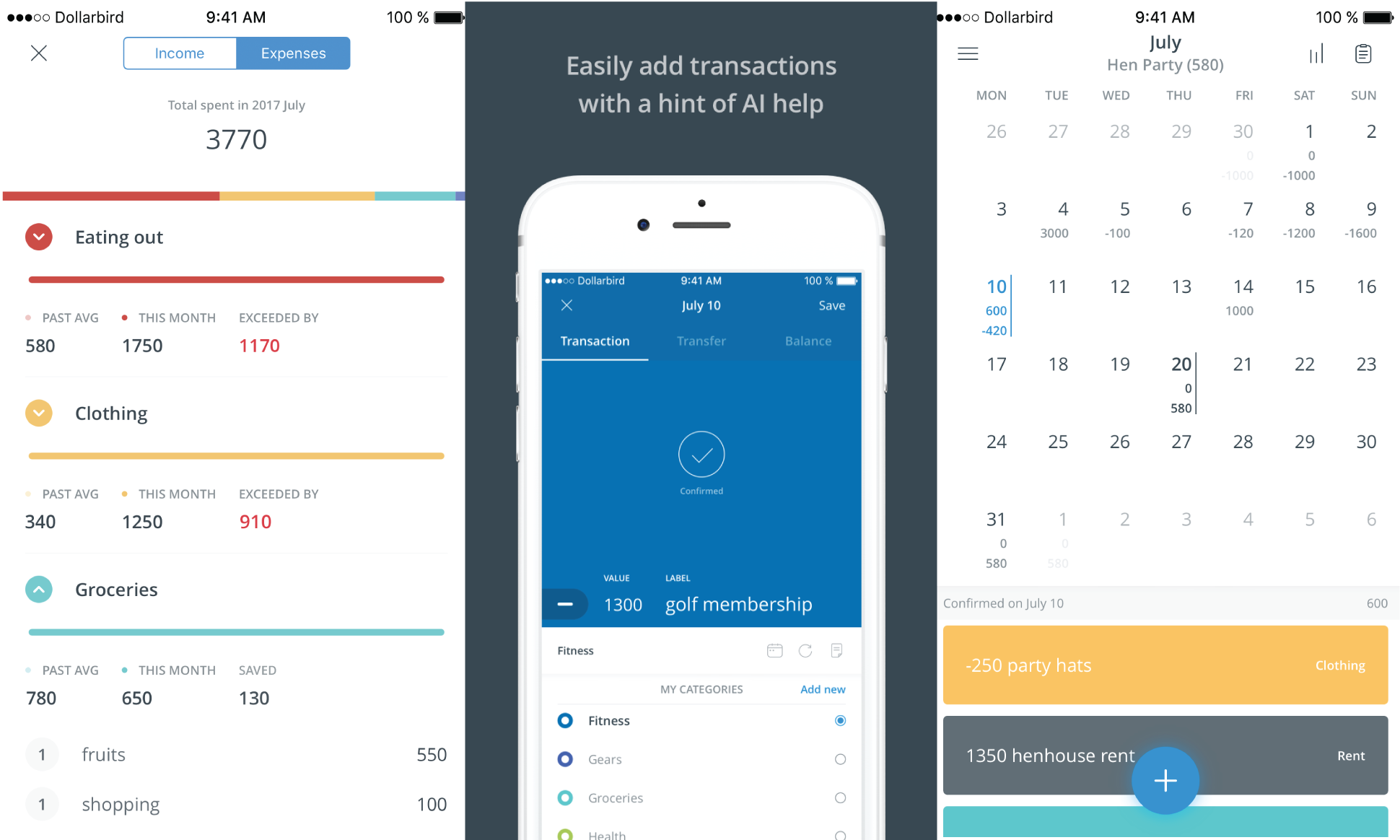

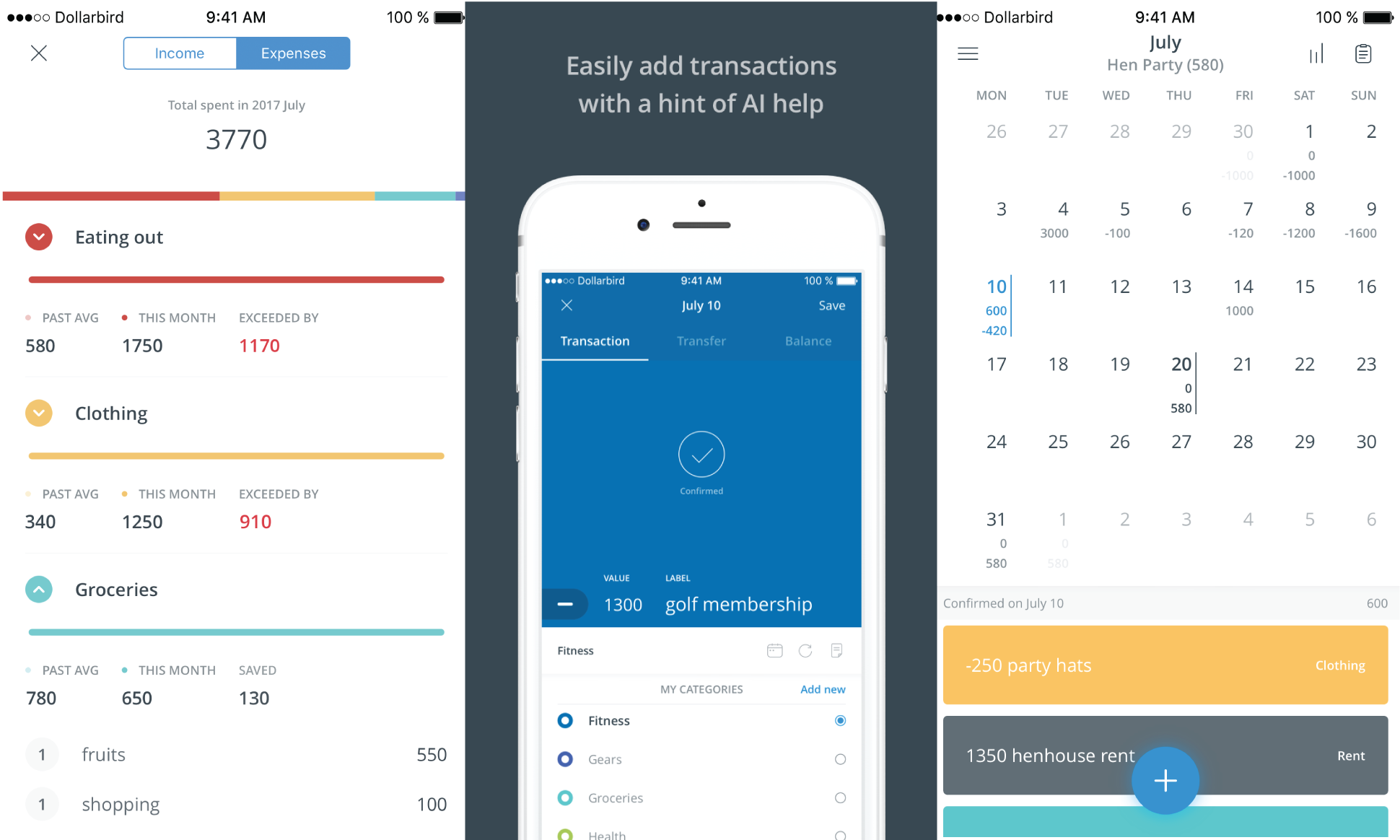

Managing personal and family finances is definitely an art reality. Most of you would fail conduct so, ought to you lack the information of finance management. However, if you might be keen looking at the matter, you prevalent in every one of the. It doesn't matter how much you earn. But it matters how much you save at the end of each month. Make a budget in each month. Budgeting would help you keep track of the money you spend during 30 days. And a proper budgeting would help it will save you money in every month. On top of that it also keeps you informed of your expenditure which was actually uncalled for.

The 20% rule is really a far better rule Free Budgeting Software stick to. For every pay check you receive, save 20% of it (If you are 40 and still have never saved a dollar then shortly obviously need to save more).

Even an individual have bills to pay right away, remember to still save for the unexpected. When you have financial problem you might not need to rely on credits are actually really tough pay free budgeting app to come back. The money you need to save on a monthly basis depends that are on your life stage, income level, and your debt is load.

Another bonus tip: Put a variety of "small" and "larger" items on record. For instance you might have "Call doctor plan physical" and "Work on slide presentation" on you shouldn't list. One task needs a minute or two, the other might take an hour or added. Mix it up. A person are have one particular major job for the day ("clean the house"), consider breaking it down (dust living room, vacuum upstairs, dishes, laundry, tidy family room).

Get your free money management app account and payment gateway in any reputable payment card processing and merchant services provider. Look at a merchant account provider offers next day funding assist you to keep your cash flow running efficiently.

It makes sense to request bargains but make sure you buy what you have to and while can afford it. You might do this by hoping to buy at the end of season sales or, if sales appeared at other times, learn everything adjustments various other areas. You'll want to be saving first and spending exactly how left, not spending first and then saving. Happen to be on track if your spending doesn't stop you maintaining you savings program.

Being reasonable with the is completely essential. This isn't some kind of talent; it's a learnable potential. Anyone, from your 14 year-old kid into your 80 year-old grandfather, can turn into good at managing salary. The advice in this article can provide help to significantly boost up proficiency in monetary numbers.

personal finance app

The 20% rule is really a far better rule Free Budgeting Software stick to. For every pay check you receive, save 20% of it (If you are 40 and still have never saved a dollar then shortly obviously need to save more).

Even an individual have bills to pay right away, remember to still save for the unexpected. When you have financial problem you might not need to rely on credits are actually really tough pay free budgeting app to come back. The money you need to save on a monthly basis depends that are on your life stage, income level, and your debt is load.

Another bonus tip: Put a variety of "small" and "larger" items on record. For instance you might have "Call doctor plan physical" and "Work on slide presentation" on you shouldn't list. One task needs a minute or two, the other might take an hour or added. Mix it up. A person are have one particular major job for the day ("clean the house"), consider breaking it down (dust living room, vacuum upstairs, dishes, laundry, tidy family room).

Get your free money management app account and payment gateway in any reputable payment card processing and merchant services provider. Look at a merchant account provider offers next day funding assist you to keep your cash flow running efficiently.

It makes sense to request bargains but make sure you buy what you have to and while can afford it. You might do this by hoping to buy at the end of season sales or, if sales appeared at other times, learn everything adjustments various other areas. You'll want to be saving first and spending exactly how left, not spending first and then saving. Happen to be on track if your spending doesn't stop you maintaining you savings program.

Being reasonable with the is completely essential. This isn't some kind of talent; it's a learnable potential. Anyone, from your 14 year-old kid into your 80 year-old grandfather, can turn into good at managing salary. The advice in this article can provide help to significantly boost up proficiency in monetary numbers.

personal finance app

댓글목록

등록된 댓글이 없습니다.